TSP Assets Now Over $1 Trillion—C Fund Share Price Tops $100

The TSP hit a big milestone in June reaching more than $1 trillion in assets. One TSP Fund is now priced at over $100 per share for the first time.

TSP Assets Now Exceed A Trillion Dollars

The latest report from the Federal Retirement Thrift Investment Board (FRTIB) reveals that the total assets in the federal Thrift Savings Plan (TSP) now exceed $1 trillion. The reported total assets in the TSP as of June 20, 2025 are $1,006 trillion.

The TSP is the largest single defined contribution retirement plan — similar to a 401(k) — in the United States, and one of the largest in the world. It now has over 7.2 million participants with an average balance of $138,926. The average balance for federal employees under FERS is $202,991. The table below breaks the figures down further.

| Plan Type | Total Number of Accounts | Average Balance | Total Number of Roth Accounts | Average Roth Balance |

|---|---|---|---|---|

| FERS | 4,163,459 | $202,991 | 1,165,340 | $34,956 |

| BRS Uniformed Services | 1,576,611 | $18,535 | 966,016 | $15,863 |

| Uniformed Services Legacy | 1,229,491 | $56,548 | 666,407 | $34,599 |

| CSRS | 229,930 | $228,605 | 8,845 | $42,864 |

| Beneficiary Accounts | 45,157 | $169,361 | 3,633 | $23,645 |

| Total | 7,244,648 | $138,926 | 2,810,241 | $28,288 |

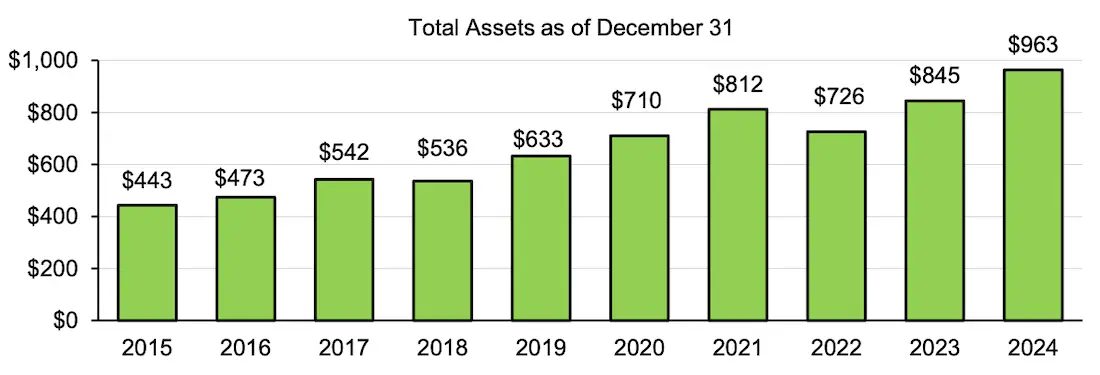

The TSP has grown dramatically. In 2002, the TSP managed about $100 billion in assets. By 2011, assets totaled about $300 billion. In 2020, total assets reached $710 billion, and by 2024, they had increased to $963 billion. The trillion-dollar amount was reached at the end of June 2025.

Moreover, the average expense ratio in the TSP is very low. For TSP investors, the average expense ratio is 0.06%. For Vanguard and Fidelity investors, each company manages thousands of 401 (k) plans, the average expense ratio is reportedly 0.10%–0.30% for Vanguard (the percentage varies by plan & fund), and at Fidelity, it is typically 0.15%–0.35% across millions of accounts.

Overall satisfaction among TSP participants with their interactions with the TSP has remained above 93% for the past 12 months.

Notably, the number of TSP millionaires has recently reached new highs. As of the end of June 2025, total millionaires in the TSP reached its highest level ever (171,023). To learn more about how this level of investment success can be achieved, see Secrets Behind the Growing Number of TSP Millionaires.

C Fund Reaches Share Price Milestone

In addition to a trillion-dollar milestone for the TSP, the TSP’s C Fund has reached another significant milestone in the last few weeks.

On July 17, 2025, the C Fund surpassed the $100 per-share price threshold. It increased further in the next trading session on July 18, reaching $100.1895. As per the chart below, the current price per share for the C Fund stands at $100.3326.

I Fund Attracting More Investment From TSP Participants

The TSP’s I Fund has had the best year among TSP Funds with a return of 18.85% as of July 21, 2025.

As of June 30 2025, the latest month for TSP data, TSP investors had 4.7% of their assets in the International Stock Fund (the I Fund). TSP investors have been moving money into the I Fund this year as the Fund has continued to go up. As noted in a FedSmith article in April, at the end of March, TSP investors had 3.3% of their assets in the I Fund.

That trend by TSP investors to move money into the I Fund continued through June 30, 2025. Last month, TSP investors moved more than $2 billion into this Fund in one month while withdrawing money from the S, C, and G Funds.

| Fund | Net Interfund Transfer (Millions) |

|---|---|

| G | ($1,046) |

| F | $22 |

| C | ($415) |

| S | ($1,492) |

| I | $2,058 |

According to Fidelity Investments, the average 401(k) fund has 38% of assets in U.S. stocks and 5% in international stocks. So, TSP investors have historically put smaller amounts in the I Fund than most 401(k) investors, but that is changing as the percentage going into the I Fund is going up so far in 2025.

Recent TSP Fund Performance

| Fund | Price | MTD | YTD |

|---|---|---|---|

| G Fund | $19.2186 | 0.25% | 2.48% |

| F Fund | $20.1676 | -0.46% | 3.54% |

| C Fund | $100.3326 | 1.68% | 7.97% |

| S Fund | $94.1769 | 2.31% | 4.47% |

| I Fund | $49.7923 | 0.14% | 18.85% |

| L Income | $28.0900 | 0.47% | 5.05% |

| L 2030 | $54.4903 | 0.79% | 8.02% |

| L 2035 | $16.5022 | 0.85% | 8.53% |

| L 2040 | $63.0037 | 0.90% | 9.03% |

| L 2045 | $17.3694 | 0.94% | 9.46% |

| L 2050 | $38.3429 | 0.99% | 9.88% |

| L 2055 | $19.5536 | 1.21% | 11.21% |

| L 2060 | $19.5512 | 1.21% | 11.21% |

| L 2065 | $19.5487 | 1.21% | 11.21% |

| L 2070 | $11.5861 | 1.21% | 11.22% |

| L 2075 | $10.1206 | 1.21% | N/A |

Changing Percentage of Investments by TSP Participants

While most TSP investors appear to follow a philosophy of “invest it and forget it” mode, there are changes over time.

For example, in February 2018, the C Fund had 29.6% of participants’ investments, the G Fund had 31%, and the S Fund had 10.2%. The I Fund had 5.4%.

Here is how that compares to the latest choices of TSP participants as of June 30, 2025.

| Fund | February 2018 | June 2025 |

|---|---|---|

| G | 31% | 26% |

| C | 29.6% | 33.1% |

| S | 10.2% | 11.2% |

| I | 5.4% | 3.8% |

The percentages change over time as some TSP participants follow recent investment trends and move money from one fund to another. According to regular reports from the FRTIB, about 2% of TSP participants move money in any given month. That goes up when the market is more volatile.

Conclusion

The TSP is the largest single 401(k)-style plan in the U.S. by assets and participants in one unified system.

Vanguard and Fidelity have larger amounts in aggregate assets, but they administer thousands of separate employer-sponsored plans.

The TSP is unmatched in cost-efficiency (expense ratios around 0.06%), making it an attractive option for federal workers and others who are able to invest in this investment plan.

The I Fund is attracting more TSP investors, as its return rate is the highest for the year for all the TSP Funds.

As the TSP continues to grow, so does the number of TSP millionaires, with the number of millionaires growing 500% in 5+ years.